The newest Apr (APR) revealed is actually for a personal loan with a minimum of $10,one hundred thousand, having a good step 3-seasons term, and you may boasts a relationship discount out of 0.25%. Once you submit the application, we’ll make you a keen a sign interest rate if you’re conditionally acknowledged. This is susceptible to verification of your advice you give us in your software.

NAB Cellular Financial application

If you are compensation agreements could affect your order, position or keeping unit advice, it doesn’t influence our evaluation ones issues. Don’t translate your order where things appear on the Web site since the people affirmation or recommendation out of you. Finder compares an array of things, team and you may services however, we do not provide details about all of the readily available things, company otherwise characteristics. Please appreciate there could be other options available to choose from compared to issues, company otherwise services included in our very own services.

If you want not to ever getting contacted, you could choose away at any time by following the newest tips given within our correspondence otherwise because of the updating your requirements. Any income tax guidance discussed are standard in general and is also maybe not income tax suggestions otherwise a guide to taxation legislation. We advice you search independent, professional tax advice appropriate to your individual things. This information is general in nature and contains already been prepared as opposed to bringing your own expectations, things and requires into account.

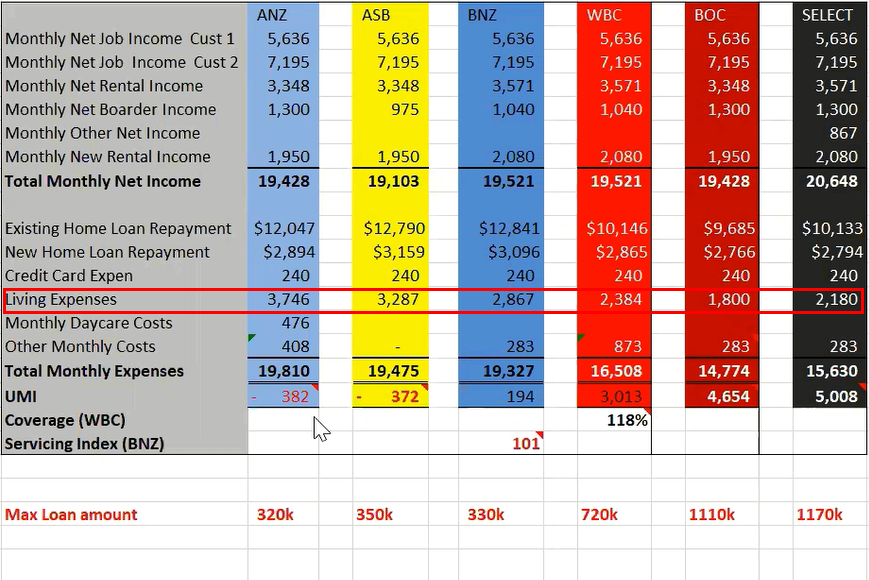

Calculations depend on a good example interest rate and therefore are prices merely. We have thought the information you may have inserted about your financial position is actually direct and will end up being confirmed from the united states. Here you will find the presumptions we now have accustomed assess just as much as how much you can acquire. Simultaneously, for individuals who don’t have your rate of interest yet ,, merely add dos% to the stated rate above on your computations to own the common signal.

From the these types of quotes

The house mortgage books will help you browse the trail to come, whether you are to purchase, building or looking to spend less on a current loan. Value of are ANZ’s valuation of your shelter assets and could differ to your rate you pay to own a house. Stop one thing out of on the internet and an enthusiastic ANZ Home loan Pro have a tendency to contact one assistance with the remainder of the program process. Let us know a while about yourself and the financing you would like, up coming we are going to name your right back inside instances to keep your application swinging.

Guess simply how much you could rescue from the refinancing with money.com.bien au.

If we don’t possess information to possess a suitable membership, the client might possibly be called thru an outbound phone call. The brand new cashback amount will be paid on the transaction account inside the which the mortgage money is disbursed within 120 months regarding the date from draw off. You may also sustain an early on Cost Cost, which can be significant, if you make early otherwise more costs.

For everybody applicable fees & costs delight understand the ANZ Private Banking account Charges and you will Charges (PDF), ANZ Private Financial General Costs and you may Charges (PDF) along with your letter away from give. When determining just how much you could obtain, lenders uses a figure labeled as the debt-to-earnings ratio (DTI) – that’s, the amount of debt you’ve got compared to your general money. You can calculate their DTI by adding up the total amount of one’s debts and splitting by your disgusting yearly money (prior to tax). The fresh fewer expenses you have, the low the new proportion – plus the best the credit electricity may be.

We’re also in control lenders, so we calculate your credit strength using the highest of your estimated expenses along with your HEM (Household Costs Scale – an enthusiastic Australian mediocre cost benchmark). The tables feature all home loans offered by loan providers to the our databases you to match the research standards selected. Lenders do not spend to feature within tables, nor can we earn fee if you simply click to go to a lender’s site. The transaction of your own items in the new dining table is not swayed by people commercial arrangements. Even as we defense a selection of issues, our very own assessment will most likely not are all equipment or seller from the field. Constantly show extremely important tool guidance to your associated vendor and study the relevant disclosure data files and conditions and terms prior to a good decision.

Borrowing energy is how much you can borrow based on the financial predicament. The more credit strength you may have, the greater borrowing limit otherwise loan amount you are able to get. To qualify for a customer relationship discount, you really need to have an excellent being qualified Wells Fargo individual family savings and create automated payments out of a good Wells Fargo deposit account. To learn which profile qualify for the newest write off, delight speak with a great Wells Fargo banker otherwise consult the Faq’s.

The pace revealed is the Ease Along with Home loan index shorter the brand new relevant special provide discount. Eligibility criteria affect unique make discounts available, and $50,100 or maybe more inside the fresh or a lot more ANZ financing. Rates of interest found on this page are current while the in the and therefore are susceptible to change.

In addition to, ensure that you have got all your more income models (including overtime or commission) integrated whenever filling out a software. Having fun with a borrowing calculator also may help provide an estimation out of what you are able obtain. Our very own borrowing energy calculator offers a fast imagine considering your earnings, expenditures and you will financial predicament. It’s a good initial step to help you learn your residence mortgage possibilities and you will plan confidently.

- Certain financial items listed in our dining tables appear due to home financing agent.

- The results from this calculator will be used because the an indication merely.

- Rates of interest referenced try most recent rates centered on Prominent and you can Attention money.

Effortless loan percentage calculator

This enables us to cause for, in order to a qualification, the outcome of interest rates increases when working out exactly how much you are in a position to afford. The total amount you could potentially borrow utilizes several things, such as your ability to comfortably build repayments. Observe far you could acquire and you may just what payments have been around in just a few easy steps. While looking for a loan, take into account the popular features of the loan device so that you determine if they is best suited for your situation. Including, if you purchase a qualified green house or apartment with possibly a green Financial or Solar Home loan then you may score a straight down rate of interest and probably obtain more.

+48 730 801 201

+48 730 801 201 kontakt@villa20sopot.pl

kontakt@villa20sopot.pl